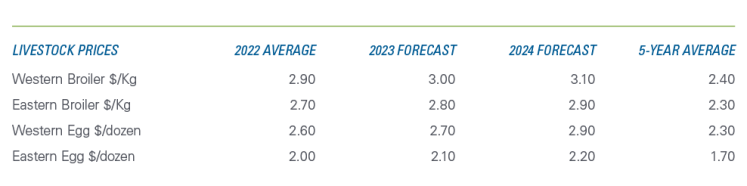

Prices in 2024 are expected to be higher year-over-year (YoY) for each poultry subsector (broilers, turkeys and layers) in the East and the West (Table 1), supported by continued strength of demand from households and foodservice sectors.

Sources: Statistics Canada, FCC Calculations

Despite some headwinds from production slowdowns, high feed costs and a recent change in tariff rate quotas for poultry, broiler operation profitability will be positive throughout the outlook period.

While feed costs have fallen from their highs in 2022, Western canola, representing meal and wheat rations will be pressured by 2023’s drought-limited production. Eastern soybeans may stay elevated with Brazil’s weather challenging production amid strong global demand.

Sources: Statistics Canada, FCC Calculations

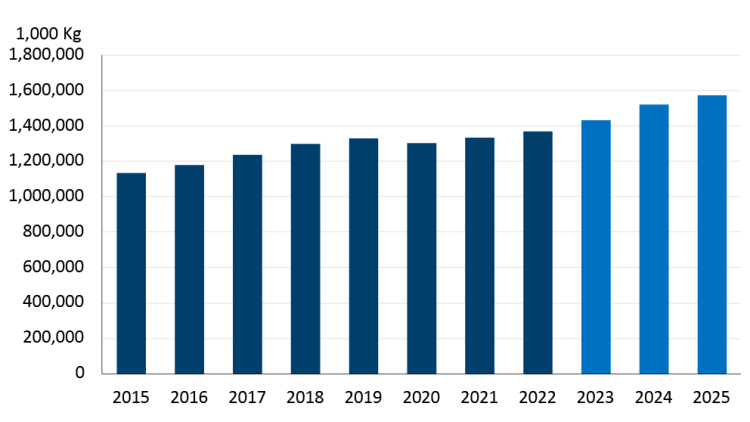

Canadian broiler production is forecast up year-over-year in 2023, 2024 and 2025 (Figure 1), but there are cautions about whether such growth is attainable. In 2022 and 2023, there have been shortfalls in production relative to allocations (i.e., planned production) deficits caused by a shortage in bird availability since early 2022. Canada and the U.S., which supplies approximately 20% of Canada’s supply of day-old chicks and hatching eggs, experienced widespread losses in their breeding and hatching flocks in 2022 due to Avian influenza. Figure 1 represents the chicken meat production best-case scenario based on population growth and current consumption trends. But, the shortages that have limited production in 2022 are expected to continue to hamper production in 2023 and 2024.

At the other end of the spectrum, the USDA’s Foreign Agricultural Service (FAS) has forecasted Canadian chicken production to grow 3% YoY in 2023 and 2.5% YoY in 2024. Through October 2023, chicken production in weight was running 1.2% higher relative to a year ago, a gain made possible by slaughtering heavier birds.

Sources: Statistics Canada, FCC Calculations

B.C. chicken meat production has been hit especially hard in a year that some are calling the worst on record. An AI outbreak (2022 –2023) has brought the province’s infected premises to 142 (of 387 for Canada), and B.C. accounts for 52% of all Canadian impacted birds as of November 19 (9.3 million birds, or less than 1% of total Canadian bird slaughter in 2022 and 2023). The total number of eggs laid in B.C. was down 14.3% YoY (January to August), and the total number of eggs laid in B.C. hatcheries (i.e., for layer and broiler production) was down even more.

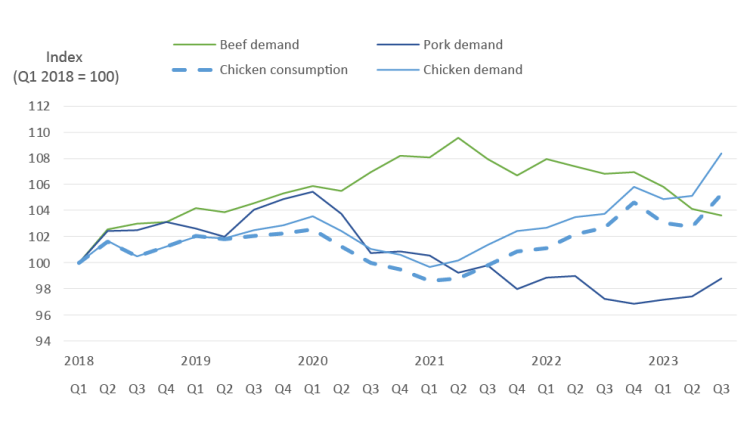

The good news for the sector is that Canadians’ appetite for chicken picked up in 2023 Q3 after showing declining interest earlier in the year (Figure 2). While beef demand continues to outweigh beef consumption and beef has been Canadians’ most preferred meat since 2020 Q1, FCC Economics’ meat demand index shows chicken meat demand (i.e., consumer preferences for chicken not explained by purely economic factors) was the highest of the three traditionally big sellers (beef, pork and chicken) in Q3. Chicken was also the meat consumed most by Canadians in that period.

Sources: Statistics Canada, AAFC, FCC calculations

Beef consumption has seen the largest decline of the three meats since 2021 Q2, with beef prices, as measured by the Consumer Price Index, rising a further 8.0% in 2023 (January to September) from already elevated levels. In comparison, chicken prices (whole chicken, breasts, thighs and drumsticks) have risen 3.2% this year to September. However, pork may pose a challenge as Canada’s pork supply is also elevated, which should keep prices more competitive.

To meet strong demand in a year of reduced production, Canadian retailers can access current production, storage stocks and imports. With production up only minimally this year, frozen chicken stocks were still enough to satisfy demand in 2022 and early 2023. U.S. imports are 7% higher YoY (September 2022 to August 2023) and may grow further in 2024 with an increase in Canada’s total tariff rate quotas to 119,000 MT, a 7.4% YoY increase.

Poultry producers will start to fill allocated production levels once the damaging avian influenza outbreaks are under control – a daunting task given the disease’s recently evolved ability to infect and kill wild bird and mammal populations. Demand is still strong from in-home dining and foodservice sectors and is currently being met with the ample frozen stocks on hand. But with prices for competitive meats still relatively much higher than those for chicken meat, we can expect Canadian poultry demand and consumption to remain high, pressuring those stocks. Population growth overall and growth stemming from immigration, in particular, will also help to boost consumption levels. Imports from the U.S. are set to increase and ease some of the pressure in 2024, but it may be a while before Canadian producers can meet domestic demand with our production.

Source: Farm Credit Canada