Source: The Wolf Report

Summary

- Tyson Foods have seen some longer-term undervaluation for its shares since the pandemic brought the price down from the low $90s way down to almost $50.

- In the $50s, the company was one of the more buyable stocks in the entire sector.

- However, appreciation and reversal of valuation have brought the company’s price level back up to better levels. The upside is slimmer, and the yield is lower.

- I consider Tyson to be barely “BUY”able today due to a combination of growth expectations and risks in the business. It could be a good option for some investors, however.

Me, I love chicken.

I grew rurally and close to farms, and always owned hens when I was younger. I love eggs, and I love chicken. It’s extremely healthy and cheap protein, and it’s extremely versatile.

Something being extremely cheap, somewhat versatile, and into chicken/poultry could be said to be true for Tyson Foods (TSN) as well. The company was extremely cheap back when COVID-19 really brought things down low, but since my early articles on the company, Tyson Foods has done some remarkable things for shareholders.

Tyson Foods – How Has The Company Been Doing

The development we’ve seen in the company’s valuation and share price is nothing strange, unexpected, or out of the ordinary. This was essentially what I was talking about back in my earlier articles on the company.

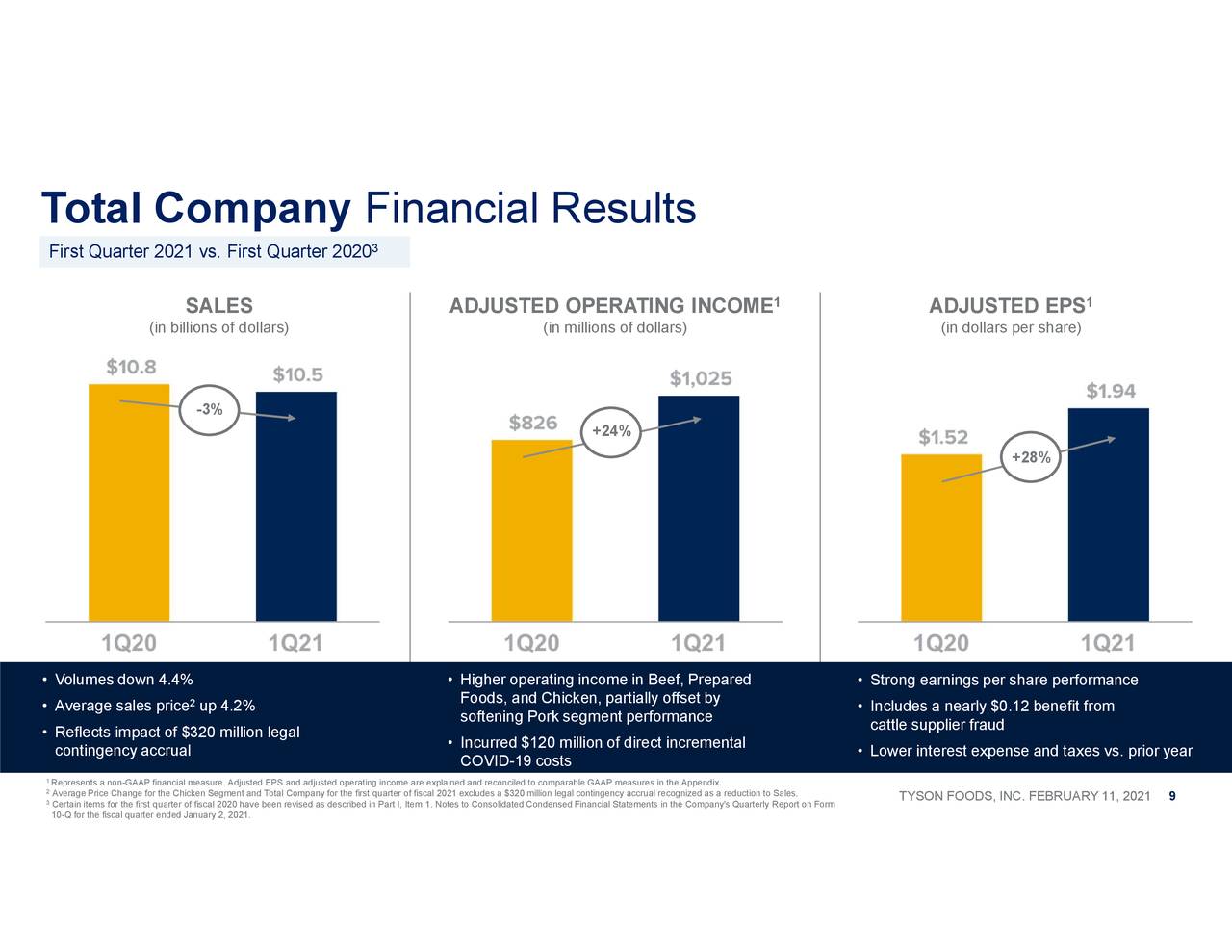

(Source: Tyson Foods)

Tyson Foods was set to outperform based on expectations and results, and that’s what happened. While GAAP EPS was down around 7%, adjusted EPS grew by about 28% YoY, and the EPS results actually beat by $0.44/share. Some great results here, if you view them in a certain light.

(Source: Tyson Foods)

COVID-19 was an event for the meat industry, and TSN is no exception. Yet TSN maintains a high degree of available liquidity with almost $4.2B as of 2nd of January 2021. COVID-19 had effects of around $120M on a direct basis, for a comparison. This is still incredibly high – consider $120M – but compared to the company’s actual liquidity and availability of capital, it’s not such a massive amount. Also, the company has already paid back 50% of the $1.5B term loan it took, with repayment done in February of 2021.

Despite COVID-19, Tyson Foods delivered over $1B in operating income for the quarter alone, with strong performance numbers from virtually all segments, including Prepared Foods and Beef.

On a segment-specific level, results here saw particular strength in sales of Beef (up 5.6% YoY) with particular YoY weakness, while strong and despite COVID-19, in the International segment and Prepared Foods. Despite negative sales development, all segments apart from Chicken reported positive GAAP operating income numbers, with Beef contributing over $500M for the quarter due to extremely strong domestic and export demand, as well as weak YoY number due to a fire incident.

Breaking down some of the trends, the company’s COVID-19 expenses can be understood as team member costs with regards to worker health, availability costs, PPE costs, sanitation costs, testing costs, product downgrades, rendered product, professional fees, and other costs. These massive costs are only slightly weighted up by CARES Act credits, and this number does not include raw material, distribution, and other CapEx costs incurred as a result of the crisis.

Therefore, it’s fair to say that COVID-19 has been of heavy impact on the company, and companies similar to Tyson Foods.

(Source: Tyson Foods)

On the basis of expectations, the company expects the remainder of fiscal 2021 to see a flat demand for domestic protein, including all of the company’s products, compared to YoY numbers. The company guides for some strength in specific segments such as Prepared Foods and Pork, but guides for Chicken to go lower due to feedstock costs (grain). The company also guides for Beef to deliver same-level or slightly lower than 2020 results.

In short, the company doesn’t want to give any expectations for any type of significant outperformance for 2021 compared to 2020, and that is indeed also not what we’re expecting.

On the fundamentals side, the company remains extremely strong and conservative despite the cyclicality of some of its segments. TSN guides for an annual interest expense of around $430M, and for liquidity to remain well above the stated target of $1B, at current levels of $4.2B. Long-term debt YoY is unchanged, and the current-level debt has increased only by $18M.

The company’s net debt/EBITDA remains comfortably at around 2.1X, which is not only lower than the number back in October but even at 2.0X on an adjusted EBITDA basis. This is superb.

In short, results were good for what the company was/is facing as a result of the pandemic.

It’s important to recall that Tyson Foods manages a team that employs nearly 140,000 people worldwide. The fact that this company operates essentially with business as usual – with important safety and procedure additions – is impressive, and the profit the company delivers despite all these problems is impressive as well.

The company has some key targets for improving the Chicken results, such as better anticipation of customer demands and channel shifts, optimization and automation to a higher degree than today, and starting up some additional, already-planned facilities.

The company’s forecast are based on a certain number of feedstock assumptions, given that Tyson buys a lot of corn and soybean and a lot of freight as well. Unfavorable, the prices of futures here and spot pricing can harm the company. The company hedges input costs, adopts different pricing mechanisms, and continues optimizing its operations here.

The outlooks which include these feedstock assumptions call for the company to deliver yearly 2021E sales of $42-$44B, which is unchanged from prior company expectations. The major changes since prior guidance include Chicken expectations, which are likely to be lower YoY, and improved outlooks for the company’s Beef segments. COVID-19 costs are expected to be around $100M higher than expected, and CapEx is expected to increase by around $100M as well. Even with all this, however, the company guides for an excellent 2021, given COVID-19 impacts, and calls for future growth based on the company’s fundamentals and strategies.

The combination of its market-leading product portfolio, scale, brands, and ongoing investments ensures that Tyson Foods is always at or amongst the top of the food chain compared to its peers here, and while competitors do exist, Tyson Foods has proven over time that it can deliver impressive shareholder returns if invested at the right valuation.

Tyson Foods – What Is The Valuation?

And this is where we run into some problems.

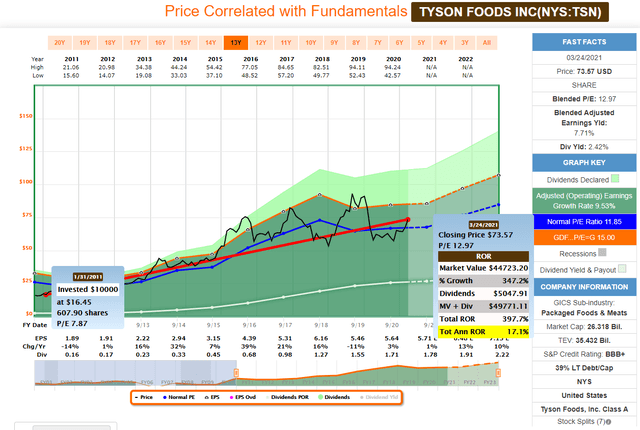

Looking at the company without paying attention to the share price, it is clear that Tyson Foods has at least a touch of cyclicality about its business. Typically, we see EPS growth dip somewhat every 5-7 years or so, but over the past 13 years, the company has maintained an EPS growth rate of about 10% per year, which is quite good.

Had you invested back in 2011, your investment would have generated annual returns of about 15-17%, which is also excellent. There were also very few times at which this company could be called “excessively valued”.

(Source: F.A.S.T. Graphs)

There were, however, a few times it could be called “significantly undervalued.” These times were, of course, the times to invest in this company in order to realize some impressive profits.

So, the situation we find ourselves in today is somewhat different. Tyson Food trades at around 13.39X P/E, which comes to almost exactly its 10-year average discount, owing in part to the aforementioned company cyclicality.

However, because the company is expected to grow earnings 8.35% on a 3-year basis annually, there is still some significant upside in the company.

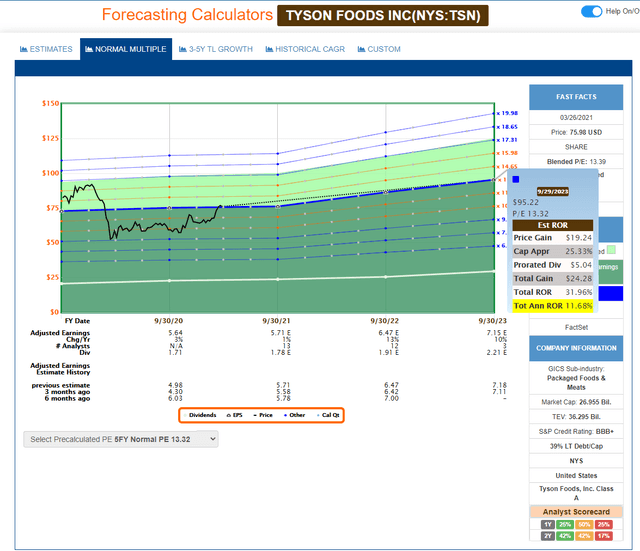

(Source: F.A.S.T. Graphs)

Tyson Foods is one of the few companies that offer a relatively conservative, 30%+ 3-year CAGR without assuming any sort of premium for the company’s valuation. Such premium may of course materialize – it has in the past – but historically, the trend has been far closer to 13X P/E. To therefore base the company’s upside on this supposed premium is a bit too optimistic to my mind.

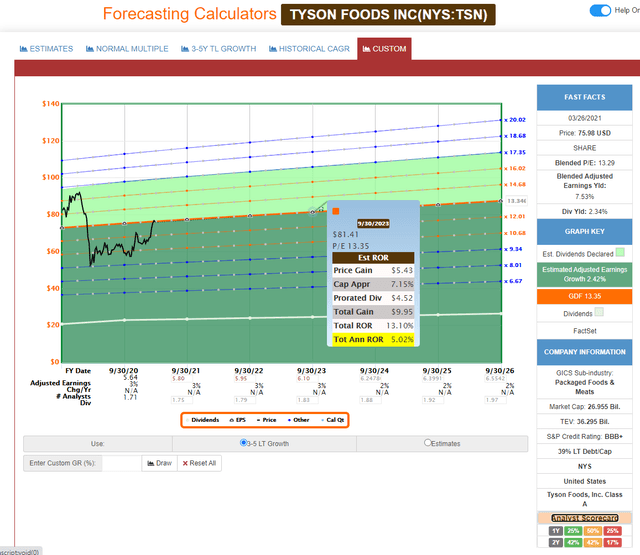

In fact, we have a risk here. If the company fails to provide the expected EPS growth, and the market doesn’t track it according to its multiple, things aren’t looking all that great. Assuming an EPS growth of only 3-4% average for the next few years, the returns you can expect based on this valuation is closer to 13% in total, which is below acceptability.

(Source: F.A.S.T. Graphs)

Some of the end markets and contexts where the company is active is characterized by higher volatility, which trickles through to earnings, which also sees volatility.

My positive stance on the company is based in part on the successful forecast or outperformance forecast tradition of the company, as well as the fundamental demographic trends of the markets where the company operates. There is going to be a higher protein demand, and Tyson Foods is one of the largest companies fulfilling the meat-side of this protein demand. The massive portfolio, the company’s history of excellent operations, and earnings speak in favor of this company at fair value, even with the slight uncertainty to the EPS growth rate.

I wouldn’t buy the company above $77/share at all, but at the current valuation, I consider the company just around where you could still potentially invest in it. There are better valuation-based investments on the market out there today, but most of these are in very different sectors than consumer staples/packaged foods & meats.

The fact that we’re able to buy a meat producer at this price point is something that should excite investors, even if the 2.34% yield isn’t exactly “up there”.

The company still trades slightly, 2.76%, below its 52-week high, and its historical 10-year returns are substantially better than many of its peers at 343%, and the company has grown its dividend at a 26% compound annual growth rate on a 5-year basis, owing to its very limited 9-year dividend history. However, this also means that the company’s payout ratio is the lowest amongst its peers at 31.30% and there’s plenty of room to grow it.

Looking at every single valuation multiple usually followed, including P/E, PEG, P/S, EV/EBITDA, cash flow multiples, and book multiples, Tyson Foods remains at a significant undervaluation to most international peers.

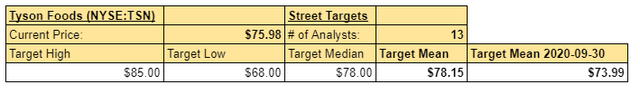

Analysts give the company the following targets.

(Source: S&P Global, Google Sheets)

I view the mean targets as somewhat risky, but not outlandishly so. Even buying at $78, you could generate impressive returns on a 3-year basis, provided the company actually delivers on current FactSet forecasts.

So, the company at current levels is a “BUY” to me.

How To Invest In Tyson Foods

Option 1 – Long-Term Investment

I consider Tyson Foods as an excellent potential investment at this time, based on its 30%+ 3-year forward upside. The common shares, to me, are the most appealing way to invest in the company because I’m looking to expand my portfolio and specifically my consumer defensive portion.

Option 2 – Selling Cash-Secured Puts

Selling cash-covered put options is another good way to make money off a company while waiting for it to drop further and making money until then. Because of the company’s position, and a lower price being even more appealing, this could make it perfect for a nice put.

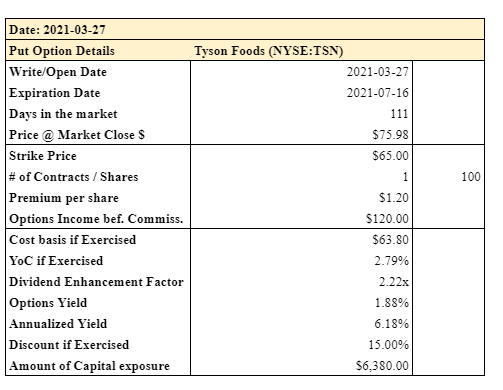

As of writing this article, I was able to find the following put.

(Source: Author’s Data, Google Sheets, Option data from IBKR/Yahoo Finance)

This is a very solid put, in my book. No, it doesn’t reach the 10% annualized yield level – but in today’s inflated market and considering the company’s upside and current price, 6.18% in 111 days is certainly not a bad return here. The capital outlay is acceptable, though I’m currently mostly doing common share investments.

I may write this put going forward.

Option 3 – Selling Covered Calls

I don’t consider selling covered calls for a company that could potentially grow further a good strategy. You might get assigned, and considering that we’re looking at 20% overvaluation before I would consider rotating profits – and this 20% overvaluation would need to include the 3-year forward numbers.

Any sensible covered call I could find goes below the 2% annualized yield rate, which to me isn’t a favorable risk/reward ratio, and I, therefore, don’t see this as an option. Despite the market being overvalued, I don’t see selling covered calls on significantly overvalued businesses as a good option. Why? Because if they’re that overvalued, such as ViacomCBS (VIAC) which dropped nearly 50% only a few days after I wrote my last article, you want to sell your stock at that overvaluation due to that specific risk, not wait for a call not to get assigned for a smaller amount of momentary profit, while losing massively in terms of total RoR. This is my view, at least.

I, therefore, view the common share investment or the put as the best choice here – either could work depending on how you want to approach TSN.

Thesis

Tyson Foods is an excellent business, based on the 10-year and long-term growth that it has provided shareholders with over that time. Managing to grow earnings as they have, investors have been well-rewarded for their faith in the company – though fundamentals have for the most part been solid for years and continue to be forecast as solid from here on out.

As to the question, if the company should be bought today, that’s a potentially different ball game. The company is at what I consider to be a full, or fair valuation of nearly $76/share. Upside from here on out is based on expectations of earnings growth rather than multiple reversion. This can be favorable if there’s a high likelihood the company will deliver such earnings growth.

I wrote in one article that I view Tyson Foods as a good investment, just maybe not the best investment that’s possible at this particular time. This is based on those two factors – multiple reversion as well as earnings growth upside. There are better options out there when we consider these factors and overall valuation.

However, seen by itself and to the exclusion of other investments, Tyson Foods is a good investment based on its upside and potential growth, one of the few companies that offer what I believe to be a risk-adjusted 30%+ 3-year upside. That’s not just worthy of note, that’s worthy of a “BUY”.

Tyson Foods is essentially fairly valued, and constitutes a “BUY” under $76/share, though the upside here is primarily based on earnings growth, not reversion.